16 Ideas for Creating Holiday Marketing Campaigns

Retail marketers around the world are making their lists and checking them twice. With the holiday season quickly approaching, the opportunity to capture new customers and experiment with new marketing strategies is here.

While the holidays are always an exciting time in the marketing world, they’re also a time of intense competition. Retailers have to put all hands on deck to make the most of the opportunity — and that’s why it’s never too early (or too late!) to start crafting your strategy.

Let’s discuss why marketing is so important during the holidays, and what you can do to make the most of your holiday campaigns.

Why is Holiday Marketing Important?

Besides the fact that nobody wants to be a Grinch, there are quite a few reasons to invest more in marketing during the holidays. This season is one of the biggest marketing events of the year:

- The holiday market is growing. In 2020, holiday retail sales in the US totaled $755.3 billion.

- Shoppers are trying new brands. With consumers searching for products for loved ones, the holidays will send troves of new customers your way. In fact, we’ve found up to 67% of Cyber Monday shoppers are first-time buyers.

- Holiday marketing tactics set the stage for next year. Almost every retailer ramps up their total number of campaigns during the holidays. This becomes the perfect environment for experimentation with new and innovative ideas.

- It provides an excellent brand building opportunity. Everyone loves a bit of holiday cheer, and focusing on the season’s merriment will help you connect with customers on an emotional level.

- There’s a huge opportunity to not only get new shoppers, but keep them. Acquiring new shoppers during the holidays is one thing, but keeping them all year round is another. By creating experiences that build towards a second purchase, you can build lifetime value with first-time shoppers.

So the holidays present tons of opportunities to connect with your shoppers in new ways. For that reason, it’s important that marketers follow a few best practices before launching any campaigns.

16 Ideas & Best Practices for Your Holiday Marketing Strategy

The months before Black Friday and everything that follows is a stressful time of year for retail marketing teams. However, there are a few tactics you can use to prepare for the flurry of activity and make this holiday season the best yet for your team.

With that in mind, here are 16 marketing ideas to help your team fully capitalize on the holiday shopping rush:

1. Build flexible email templates

The best way to stay ahead of the holidays is to build flexible email templates that you can use to promote different products as needed. These templates should be extremely simple (think a call to action, four product blocks and a footer), that way you can swap out elements and use them to promote anything you need at a moment’s notice. With these kinds of templates in hand, you should be able to clear new emails from build to send in about an hour.

2. Increase average order values through strategic messaging

To combat the increase in shipping costs and consolidate volume, incentivize customers to increase their average order value. Significant benefits also exist from increasing order sizes beyond the holiday season, as our data has found that customers who spend more tend to engage with emails more and unsubscribe less.

Focusing on the imminent holiday season, there are several ways your team can use email to accomplish this goal. For example, you can include banners to remind customers to purchase gifts for everyone on their holiday list and feature best selling products across various categories (i.e., men, women, children) in the body of the email. These curated recommendations will encourage customers to shop across multiple categories, which will increase average order values.

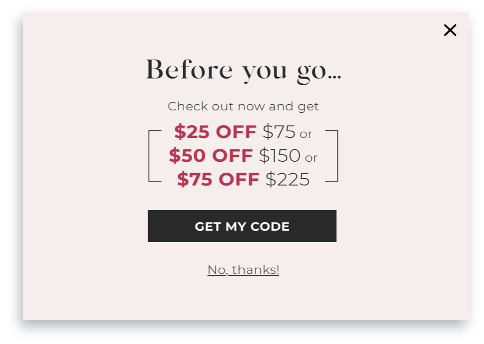

Another approach is to provide tiered offers that give customers a greater percentage off their total cost when they purchase more items. This approach is likely to be particularly effective for customers who are on the cusp of receiving an additional discount. With Bluecore Site™, you can also promote these tiered offers on your ecommerce website and even target customers with different offers based on their discount preference to preserve margins on those shoppers who don’t need a discount to buy.

It also pays to think about increasing your free shipping threshold. This increase will incentivize customers to add more items to their cart to get them over that threshold. Your team can also hold special free shipping flash sales targeted specifically to discount buyers to encourage them to purchase during a limited window to qualify for that offer.

3. Target shoppers relevantly based on inventory

As you advance into November and December, chances are that a few items will see unexpected demand. While more sales are usually a good thing, the best marketing campaigns can fall apart if the inventory they promote isn’t available. And that’s a fast way to lose trust with shoppers.

You can avoid falling into this trap by leading your campaigns with inventory availability — as long as you do so in a relevant way. Specifically, with a marketing solution that has a living product catalog, your team can run campaigns based on changes in product availability without any worries about data feeds. From there, you can build audiences of shoppers who are interested in the available products based on past behavior and predicted affinities.

This approach allows you to alleviate concerns around promoting sold out products while remaining highly relevant in your marketing.

4. Bridge the IRL-URL divide

In 2020, we saw the first digitally-dominant holiday season. This trend is expected to continue into 2021 and beyond. As a result, it will be important for retailers to bridge the “IRL-URL divide” by offering engaging digital experiences for shoppers that help recreate the feeling of shopping in stores. For example, this might include offering virtual personal shoppers or digital store events, particularly for customers with a high predicted lifetime value.

5. Unite with other marketing stakeholders

Make sure you stay in close contact with your merchandising team so that you always have a pulse on which products need to get pushed heavily. Along the same lines, it’s important to review the merchandising insights from your holiday email campaigns (e.g. which products are typically bundled together, which categories are most popular during the holidays, etc.) so that both your marketing and merchandising teams understand how those products perform with customers.

It also pays to buddy up your email and paid media teams so that both groups can use the same (or similar) audiences across channels. Collaborating in this way will ensure you get consistent messaging in front of your holiday shoppers wherever they are. As a bonus, it will also help lighten the workload a bit for both teams, since each group won’t have to take separate steps to build audiences and determine the best offers for those customers. Keeping customers at the center of your marketing team will allow you to provide an amazing experience and your team to be on the same page.

6. Target previous holiday shoppers based on when they typically purchase

Some customers are only holiday shoppers — they buy from retailers a few times a year as gifts for friends and family. It’s important to stay top of mind for these customers going into the holiday season, for example by sharing special “come back” messaging and personalized product recommendations based on their previous purchases.

For instance, reach out to early bird shoppers who bought during November of last year with a gift guide at the very beginning of November. Meanwhile, target shoppers who bought between December 1-10 of last year with “just in time” messaging and go after shoppers who bought in the second half of December with last chance offers and expedited shipping.

7. Automate personalization to drive speed and scale

Timing is everything during the holiday season. That means you need quick and effective ways to bypass long, manual campaign creation and approval processes.

To accomplish this objective, you need technology that gives your team access to real-time ecommerce data and offers AI-driven personalization. This type of solution should help automatically personalize campaigns to provide the necessary speed to launch by feeding that real-time data into AI models that can surface predictive insights, such as product or category affinity and discount affinity.

Ultimately, this type of solution enables your team to automatically personalize emails based on customer preferences and drive personalization through everything from audience targeting to personalized product recommendations. Critically, this solution should enable your team to do all of this on their own without any additional IT or data resources.

8. Develop gift guides for different types of shoppers

Find common themes among last year’s holiday shoppers (e.g. those who purchased products under $25) and target them with gift guides featuring products that fit into that theme. For example, you might develop a “Stocking Stuffer” guide with lower priced products sorted by best sellers for shoppers who purchased products under $25 last year.

Most importantly, make sure you don’t just set it and forget it with these gift guides. To keep your guides fresh, regularly update the products you feature as the holiday season unfolds by adding in trending products or products that need a little extra support.

9. Create a unique experience for gift givers

The holiday season is unique because many of your purchasers during this time aren’t actually your customers — but their loved ones are. Identify and target customers who purchased a gift card during the holiday season last year and target them with gift guides. You should also make it easy for them to purchase another gift card and create a sense of urgency around timing throughout all of your emails to this audience.

10. Encourage gift buyers to treat themselves

If you can identify which of your holiday shoppers bought a gift (for example if they purchased a gift card or checked a box not to include the receipt), follow up with post-purchase messaging that encourages them to treat themselves.

Normally post-purchase messaging would encourage buyers to make another purchase by sharing related products, but if you know someone bought a gift, you should tweak the content of the email to make it more relevant. For example, you might include messaging like “You deserve something for yourself” and share your best sellers.

11. Turn one-time holiday buyers into repeat shoppers

The fact of the matter is, some people will never be your customer when it comes to buying for themselves, but these people bought from you once because they have someone in their lives who is your target customer. In these cases, reminding customers to buy a gift at key times can help keep them coming back.

To set this strategy into motion, you might look at people who browsed and purchased around the holiday season or other popular gift-giving times like Valentine’s Day and Mother’s Day and reach out to those customers with regular reminders to purchase a gift during those times of the year.

Another unique approach would be to offer customers a “gift reminder” by asking them to input the gift recipient’s birthday so that you can send them a reminder to buy a present then too.

12. Extend the reach of category-specific promos with predictive audiences

It’s always important to speak to customers in targeted ways based on unique factors, including their lifecycle stage and predicted affinities. This imperative becomes even more important during the holiday season, when competition increases and shoppers’ inboxes become even more crowded than normal. That’s because one of the best ways to cut through the noise is to share personalized messaging and offers based on each customer’s unique needs.

You can start by targeting customers with a predicted affinity for specific categories to extend your reach beyond past viewers and purchasers without risking customer fatigue or list health. To best target this audience, feature product recommendations based on best sellers in the promoted category.

13. Preserve margins by targeting customers based on discount affinity

We’re primed to think of the holiday season as being all about discounts, but the truth is not all customers need a discount (or the same discount) to buy. Instead, it pays to target customers with unique offers based on their discount affinity. Doing so can help protect margins while staying competitive, especially at a time when many retailers are hoping to make up for lost revenue from the first half of the year.

Building on the above, it’s important to note that discounts should not be the way you create value. Offering steep discounts for non and one-time buyers isn’t the best approach, since promotions that drive acquisition see the sharpest decline in repeat purchases and train customers to be price sensitive when shopping with your brand. One alternative is to promote non-monetary rewards and loyalty programs as a way to offer value beyond discounts for these customers.

Of course, deals are a hallmark of any holiday season, and this isn’t to say you should avoid all discounts if that’s something your brand normally does. However, you need to set guardrails around what types of discounts you will offer, especially based on how they will eat into your margins. This is especially important because deep discounts often breed one-time buyers, who are extremely expensive for your brand to begin with, but even more so if their one purchase has little-to-no profit margin. Instead, your brand should use the holiday season to grow and solidify relationships with customers that will drive repeat purchases and lead to paybacks well beyond December.

14. Maintain list health by going outside of email

If a segment of your email subscribers aren’t opening your emails, it’s crucial to scale back your outreach frequency. When it comes to email, poor engagement doesn’t only translate to fewer sales: It also affects your overall email deliverability.

To get around this challenge, find shoppers with a high predicted lifetime value and high likelihood to unsubscribe and target them on social media instead of email. Although it will cost more, the returns should be worthwhile because these shoppers have a high lifetime value and are at risk of unsubscribing.

15. Capitalize on the Extended Holiday Shopping Season

The holiday shopping season keeps getting longer and longer, and you can definitely use that length to your advantage. For instance, you can create an audience of shoppers who bought early on in the holiday season and send them an email encouraging them to make another purchase.

For these communications, you might share recommended products based on other popular gifts, ask “did you forget someone?” or offer free shipping for customers who buy again.

16. Think past the holiday rush

When December 24 hits, your team will want nothing more than to be done with the holiday rush, but there’s still time to boost sales before the end of the year. Specifically, plan for a one-time post-holiday winter clearance email that targets shoppers who viewed but did not purchase products in the past 60 days (depending on when your brand starts promoting holiday, you can always expand on the lookback window to include all holiday browsers). Feature the products they recently browsed and use your email subject line to create a sense of urgency. As a bonus, you can even layer in predicted discount affinity when building this audience.

A Shining Opportunity

The holiday season is a golden opportunity for retail marketers, but it’s also one of the most challenging times of the year. To cut through all of the noise, it is crucial that retailers brush up on their strategy well before the holiday rush truly begins. If you plan everything right, you won’t only be rewarded with unmitigated campaign success — you’ll start the new year off stronger than ever.